Datev Lohn

Introduktion

In this document, you will find information about the Datev Lohn und Gehalt integration.

Note! Datev offers multiple salary systems, and this integration is for the one called “Lohn und Gehalt”.

- How to set it up

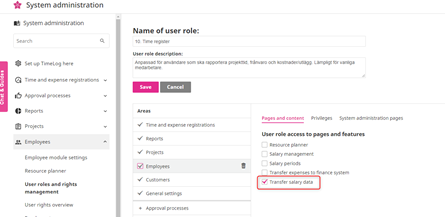

- Absence code recommendations and what is hard coded

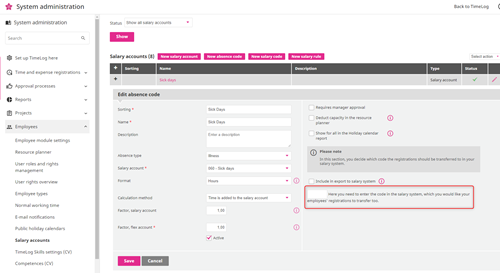

- What we transfer

Beskrivelse

How to set it up:

The Datev Lohn und Gehalt integration is a file integration, meaning it works like our DanLøn integration, where it generates a file, the user must import to their Datev Lohn und Gehalt.

When you set up the integration you must complete the following steps:

1. Make sure you have activated Employee ID in TimeLog and added the Datev Lohn und Gehalt salary ID on each employee in TimeLog.

https://app.timelog.com/Settings/Employee/EmployeeSetting

2. Go to the system administration à Integrations & API à Add the Datev Lohn und Gehalt integration

3. When adding the integration, you need to input (all can be found in the customers Datev Lohn und Gehalt):

- File prefix

- Customer no.

- Tax consultant no.

4. Select what data you want to transfer

5. Remember to enable “transfer salary data” under “user roles and rights management” in the system administration. You will find it in the area “Employees”

6. The last step, before you are ready to transfer a file is to add the correct salary codes in the absence codes in the system administration. Please see the recommendations in the next section.

7.

- Now you are ready to transfer your salary data

Absence code recommendations and what is hard coded

Here you will find a list, of the recommended salary codes that you need to add on the absence codes, that will be added to the export file:

- Vacation = 1630 (days) 1600 (hours)

- Sickness = 1650

- Time in lieu = 1910

- Maternity leave = 3340

- Paid Absence = 1080

- Mileage rates:

- Non-taxable share = 2957

- Taxable share = 2970

For a list of all codes provided by Datev, please see https://apps.datev.de/help-center/documents/9226266

Vælg venligst tommel op eller ned.

Skriv venligst en kommentar.